BEARISH FLAG PATTERN / BEARISH FLAG CHART PATTERN / CHART PATTERNS

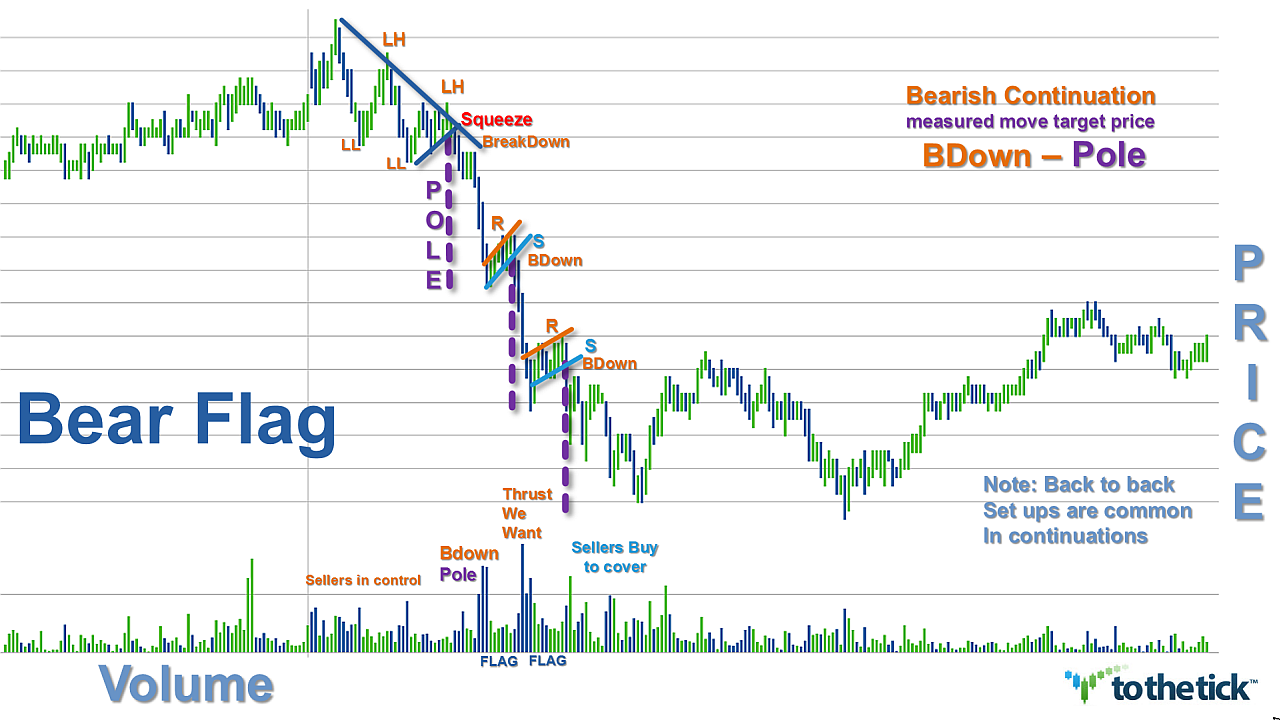

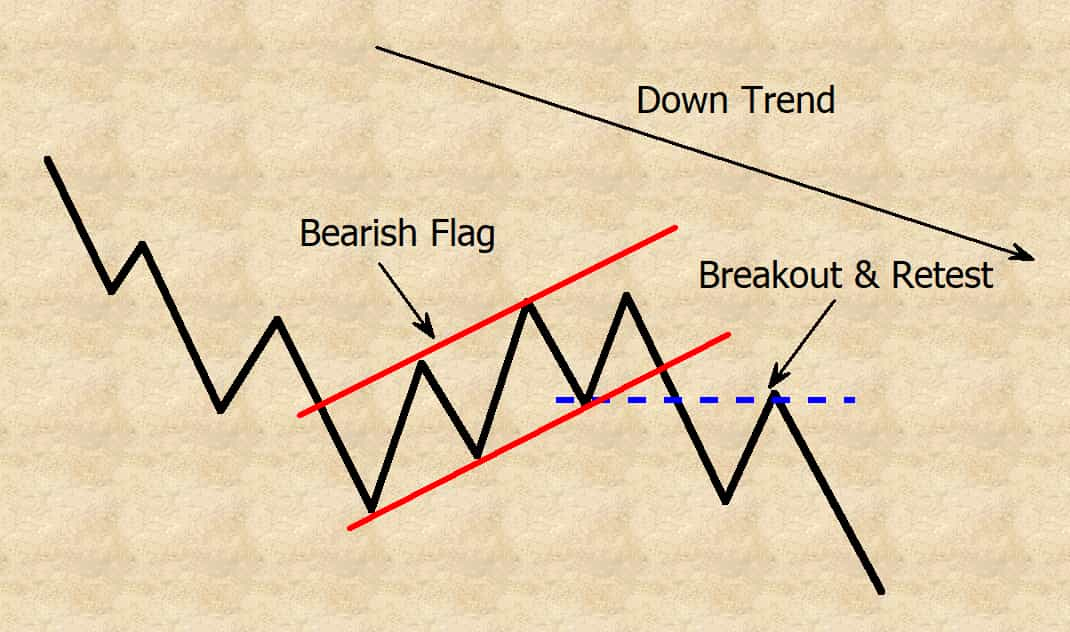

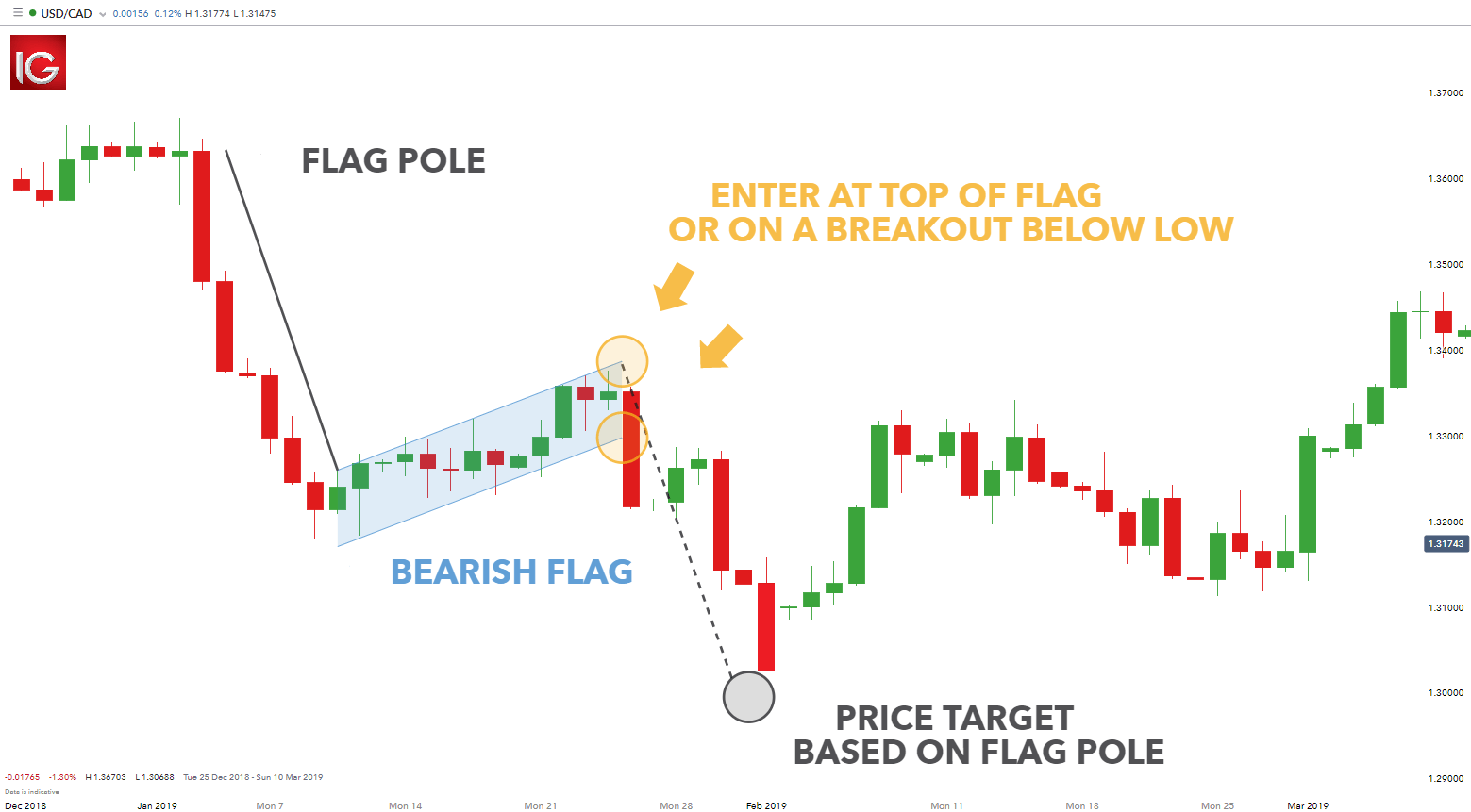

The bearish flag is a candlestick chart pattern that signals the extension of the downtrend once the temporary pause is finished. As a continuation pattern, the bear flag helps sellers to push the price action further lower. After a strong downtrend, the price action consolidates within the two parallel trend lines in the opposite direction of the downtrend.

What Is A Bear Flag Pattern? Coin Newsly

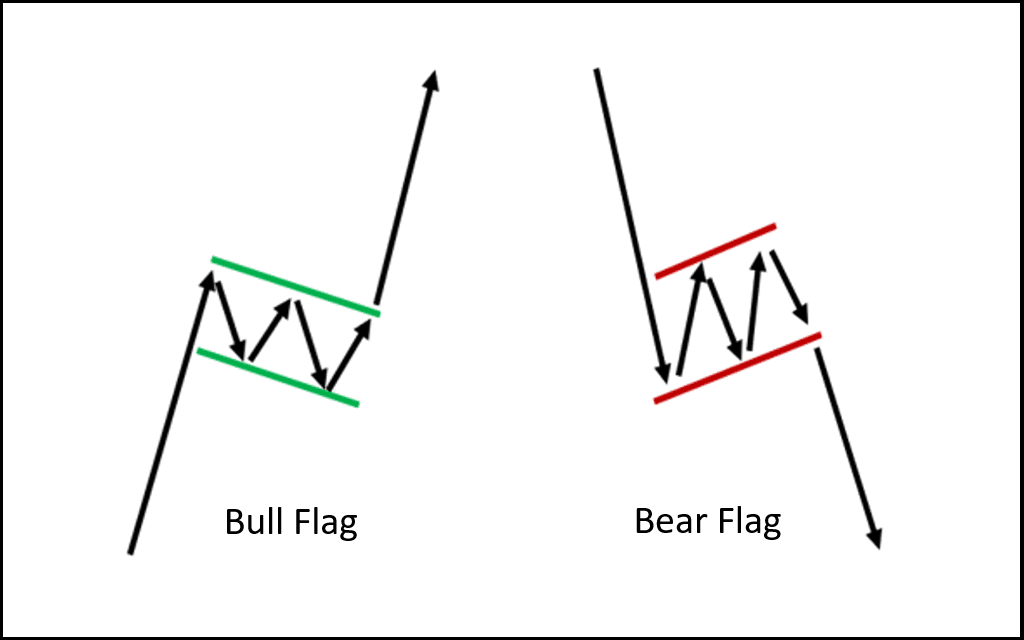

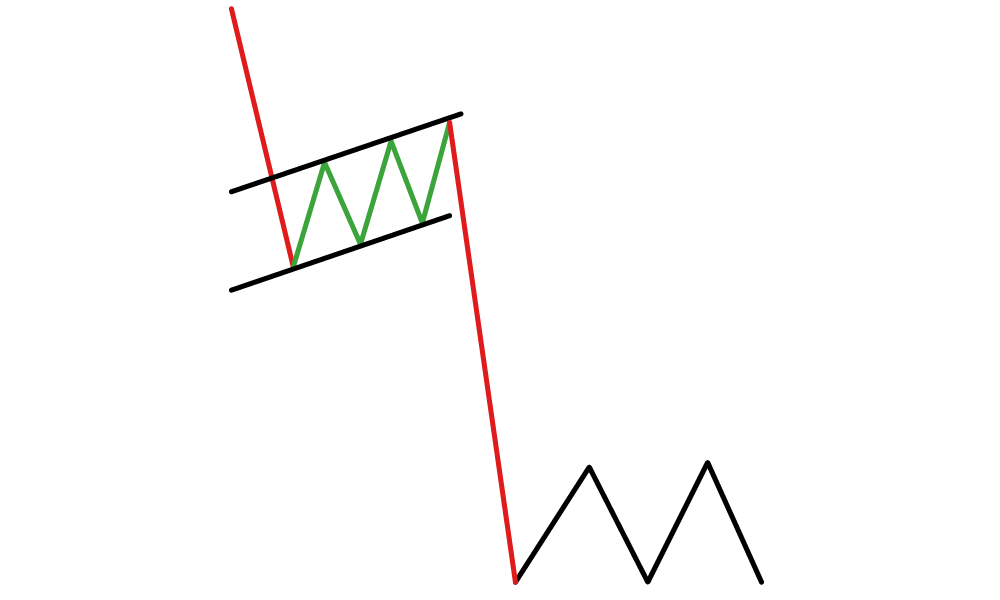

Flag patterns can be either upward trending ( bullish flag) or downward trending (bearish flag). The bottom of the flag should not exceed the midpoint of the flagpole that preceded it..

FLAG PATTERNS FX & VIX Traders Blog

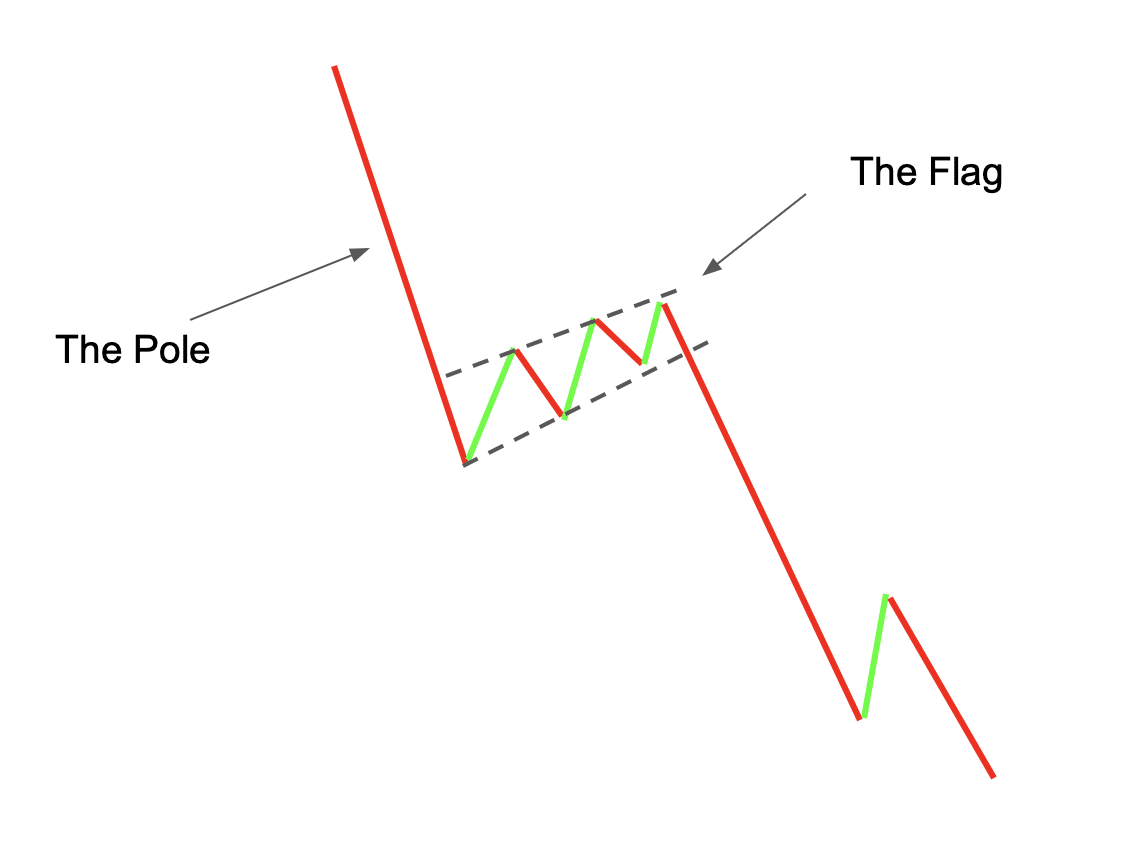

Bear flag patterns are one of the most popular bearish patterns. They consist of either a large bearish candlestick or several smaller bearish candlesticks down, forming the flag pole, followed by several smaller bullish candlesticks pulling back up for consolidation, which forms the flag.

Bearish Flag Chart Pattern

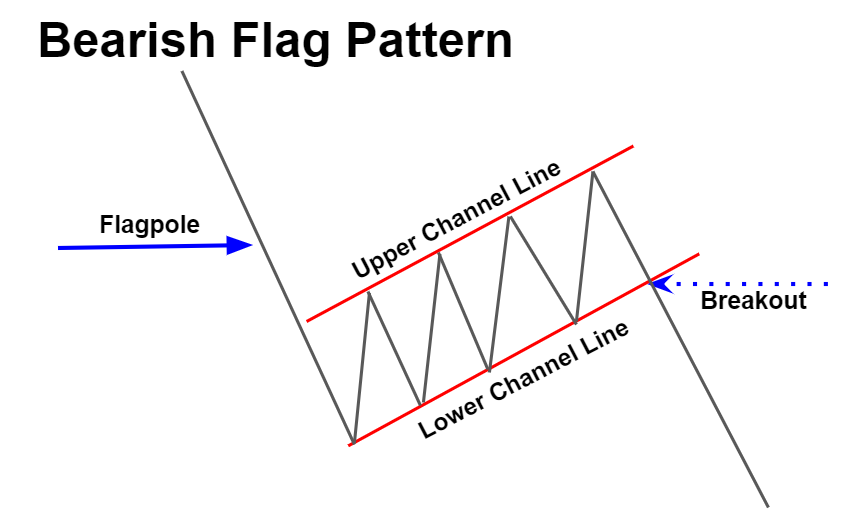

A flag pattern is a type of chart continuation pattern that shows candlesticks contained in a small parallelogram. It is an area of consolidation which shows a counter-trend move that follows after a sharp price movement. The pattern consists of between five to twenty candlesticks.

Bearish Flag Pattern Explained with Powerful Trading Plan ForexBee

A bear flag is a bearish trend continuation pattern used in technical analysis by traders to identify new downtrends with traders entering sell trades when the price breaks below the support breakout point Bear flag patterns require a flagpole, upward sloping resistance trendline, and an upward sloping support trendline to form

Bear Flag ToTheTick™

The bearish flag is a bearish continuation pattern - in other words, it tells us that an existing downtrend will continue.

What Is A Bear Flag Pattern?

The bear flag pattern is a significant instrument in technical analysis that uses a chart pattern to signify the continuation of an ongoing downward price trend. It represents a bearish market sentiment and reflects that the ongoing downtrend will likely persist after a brief consolidation period.

How To Catch High Profiting Moves With Continuation Price Patterns

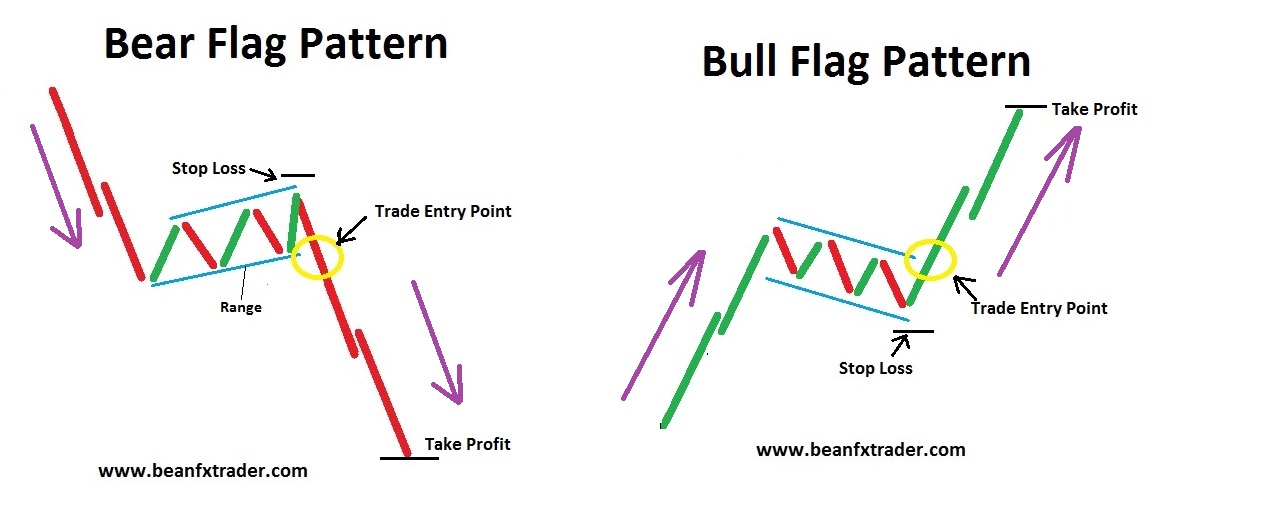

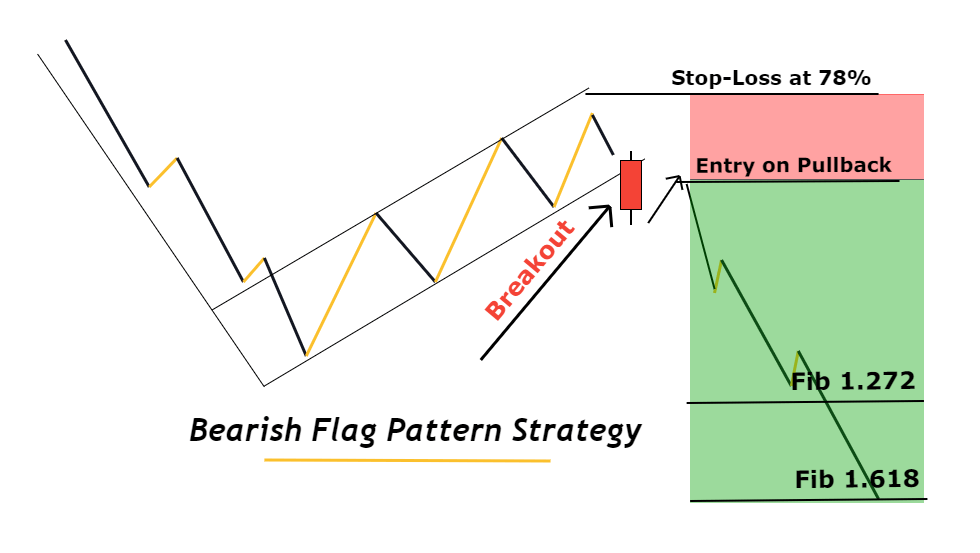

Identifying potential entry and exit points in the bearish flag pattern: Sell at the closing candle that generates the flag breakout for entry. Place the protective stop-loss slightly above the flag to manage risk. Set the take profit target equal to the same price distance of the flag pole measured down from the top of the bearish flag.

Topstep Trading 101 Flag Patterns

A bearish flag is a technical analysis pattern that signals the continuation of a downtrend. First, the price falls sharply in the chart for several candlesticks, the flagpole is formed. Next, the decline stops, forming a low point. The price reverses, that is, the bulls try to prevent the market from falling.

Learn About Bear Flag Candlestick Pattern ThinkMarkets EN

A bearish flag pattern is the opposite of its bullish counterpart. It forms during a downtrend and signals a continuation of the downward movement. Overview. The bearish flag pattern consists of a strong downward move, known as the flagpole, followed by an upward-sloping consolidation, which forms the flag. The pattern is confirmed when the.

What is a bearish flag? อ่านที่นี่ Is a flag bullish or bearish

What is a Bear Flag Pattern? In the technical analysis of financial markets, a flag is a classic pattern appearing on a chart that shows a tight consolidation in the price or exchange.

Bearish Flag Strategy Quick Profits In 5 Simple Steps

The bearish flag is a very simple continuation pattern that develops after a strong bearish trend. It doesn't really matter if your preferred time frame is the 5-minute chart or if you prefer a long-term chart. The bear flag pattern shows up with the same frequency on all time frames.

What Are Price And Trading Charts? OneUp Trader Blog

The bearish flag is a candlestick chart pattern that signals the extension of the downtrend once the temporary pause is finished. As a continuation pattern, the bear flag helps sellers to push the price action further lower.

Bearish Flag Chart Pattern Trading charts, Forex trading quotes

Trading a Flag pattern in chart involves a systematic approach to capitalize on the anticipated continuation of a downtrend. Let's analyze the bearish flag chart pattern with the help of a chart. 1 - Sell entry When the price crosses below the support line, where a breakout is expected to occur, Place your sell entry.

How to Trade a Bearish Flag Pattern

The bear flag pattern is a price chart formation that suggests a further extension of a prevailing downtrend. Bear flags consist of two parts: the flag pole and the flag. The flag pole is a pronounced downward price movement, while the flag is a period of sideways price action.

What Is Flag Pattern? How To Verify And Trade It Efficiently

A bear flag is a technical analysis pattern that can indicate a potential price reversal in a financial market. It is formed when the price of an asset experiences a sharp decline, called the "pole," followed by a period of consolidation, which is commonly referred to as the "flag."